how much is tax on food in massachusetts

50 personal income tax rate for tax year 2021. This page describes the.

You are able to use our Massachusetts State Tax Calculator to calculate your total tax costs in the tax year 202223.

. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. A state sales tax. Our calculator has recently been updated to include both the latest.

The meals tax rate is. While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. The administration said eligible taxpayers will receive a credit in the form of a refund that is approximately 14 of their Massachusetts Tax Year 2021 personal income tax.

Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625. The tax is levied on the sales price of the meal. A state excise tax.

A local option for cities or towns. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. Instead you pay 10 percent on everything up to 9950 then 12 percent on the excess up to 40525.

The tax is 625. The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam and telecommunications services 1 sold or. Massachusetts law makes a few exceptions here.

How much is tax on food in Massachusetts. Your average tax rate is 1198 and your. For example while a ready-to-eat sandwich sold at a deli would be taxable a pound of turkey would be tax exempt.

If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667. Prepared Food is subject to special sales tax rates under. The Massachusetts sales tax is imposed on sales of meals by a restaurant.

Massachusetts Income Tax Calculator 2021. 625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or. The base state sales tax rate in Massachusetts is 625.

Most food sold in grocery stores is exempt from sales tax entirely. How much does a single person pay in taxes. For tax year 2021 Massachusetts has a 50 tax on both earned salaries wages tips commissions and unearned interest dividends.

The sale of food products for human consumption. Clothing purchases including shoes jackets and even costumes are exempt up to 175. State Auditor Suzanne Bump announced Thursday that.

Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. 22 percent on taxable. Massachusetts officials announced last week that 3 billion in surplus tax revenue will be returned to taxpayers.

The Massachusetts sales tax rate is 625 as of 2022 and no local sales tax is collected in addition to the MA state tax. In general the administration said eligible taxpayers will receive a credit in the form of a refund that is approximately 13 of their Massachusetts Tax Year 2021 personal. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a.

The meals tax rate is 625. 625 of the sales price of the meal.

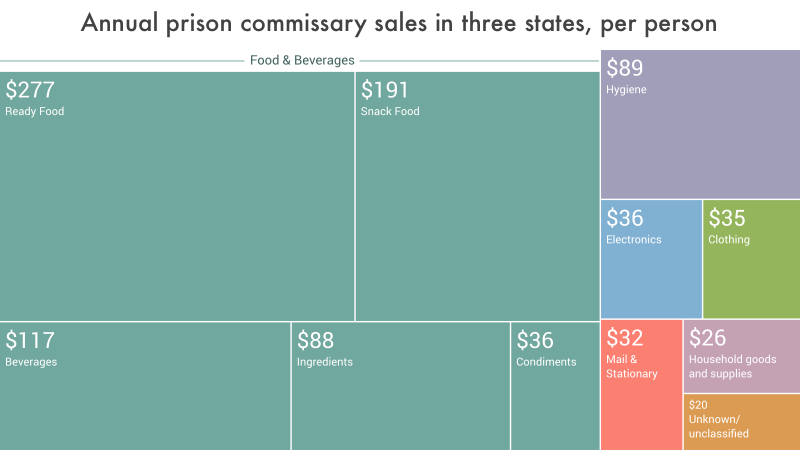

The Company Store Prison Policy Initiative

Massachusetts Dual Tax Rates A Case Study In Worcester Masslandlords Net

Low Income Housing Tax Credit Impact In Massachusetts Mel King Institute

Massachusetts Sales Tax Table For 2022

Kevin Mass Food Tax Isn T A Math Problem It S A Moral Problem

Massachusetts Budget And Policy Center The Boston Globe Today Cites A Massbudget Paper In About An Emerging Consensus That Massachusetts Needs Additional Revenue To Fund Shared Priorities Like Education Transportation Housing

The Lowdown On The Massachusetts Millionaires Tax Ballot Question Tufts Now

Pioneer Supports Legal Challenge To Misleading Tax Ballot Language Releases Video Economic Opportunity Latest News

For The First Time Massachusetts Marijuana Excise Tax Revenue Exceeds Alcohol Massachusetts Beverage Business

Massachusetts Legislature Passes Bill To Provide Immediate Relief To Municipalities And Others During The Ongoing Covid 19 Crisis Senate President Karen E Spilka

Massachusetts Tax Rates Rankings Ma State Taxes Tax Foundation

In Massachusetts Marijuana Has Surpassed Alcohol In Sales Tax Revenue

Massachusetts Income Tax Rate Will Drop To 5 On Jan 1 Masslive Com

Marijuana Tax Revenue Surpasses Alcohol In Mass Boston News Weather Sports Whdh 7news

The 15 Best Restaurants In Attleboro Massachusetts Nov 2022 Selection By Restaurantji

Massachusetts 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Food And Grocery Stores For Sale In Massachusetts Dealstream

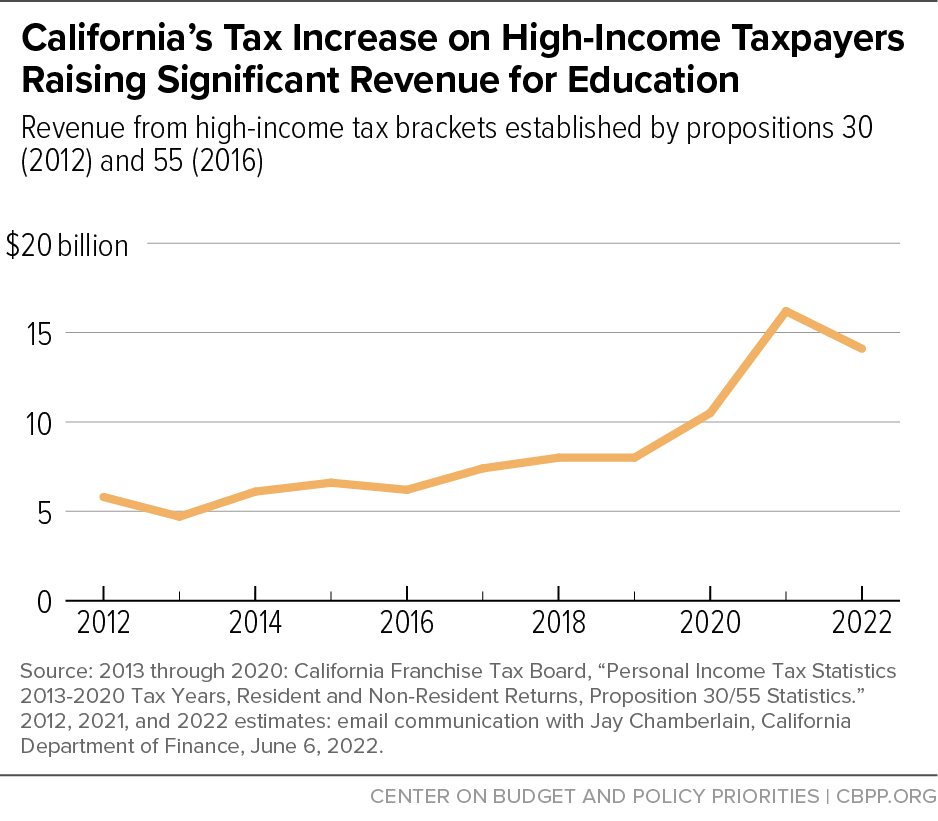

Massachusetts Ballot Measure Would Raise Billions For Education Infrastructure Center On Budget And Policy Priorities

Massachusetts Announces Additional Businesses Tax Relief Measures Focused On Restaurant Hospitality Sectors Massachusetts It S All Here